tax forgiveness pa chart

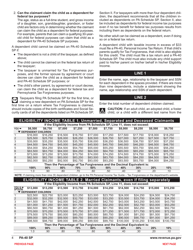

The child must file a tax return and a pa schedule sp. 90 percent tax forgiveness if their eligibility income is more than 32000 but no greater than 32250.

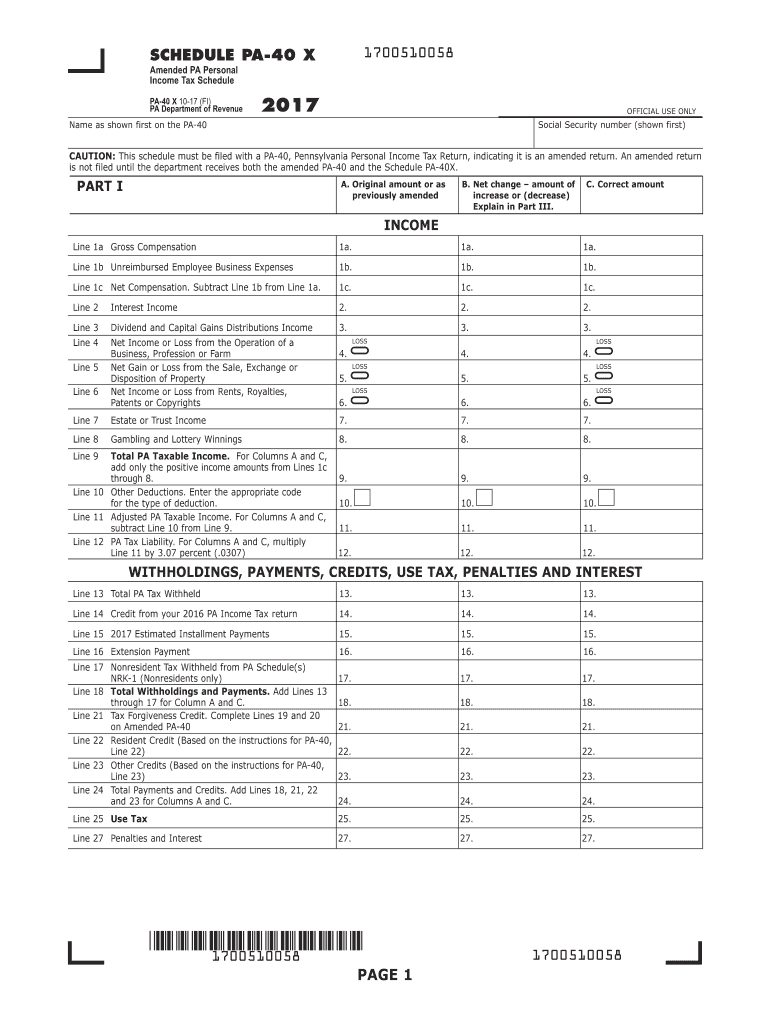

Pa Schedule Pa 40x 2017 Fill Out Tax Template Online Us Legal Forms

Content updated daily for tax forgiveness pa.

. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. These standards vary from state to state. Click the Tax Forgiveness Chart link to see teh PA Schedule SP Eligibility Income Tables.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. The IRS Can be Very Reasonable if You Know How They Work. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

Rate answer 1 of 3 Rate answer 2 of. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. Provides a reduction in tax liability and.

To claim this credit it is necessary that a taxpayer file a PA-40. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Their joint PA tax return should show they owe 368.

See How We Can Help. Ad Apply For Tax Forgiveness and get help through the process. Provides a reduction in tax liability and B.

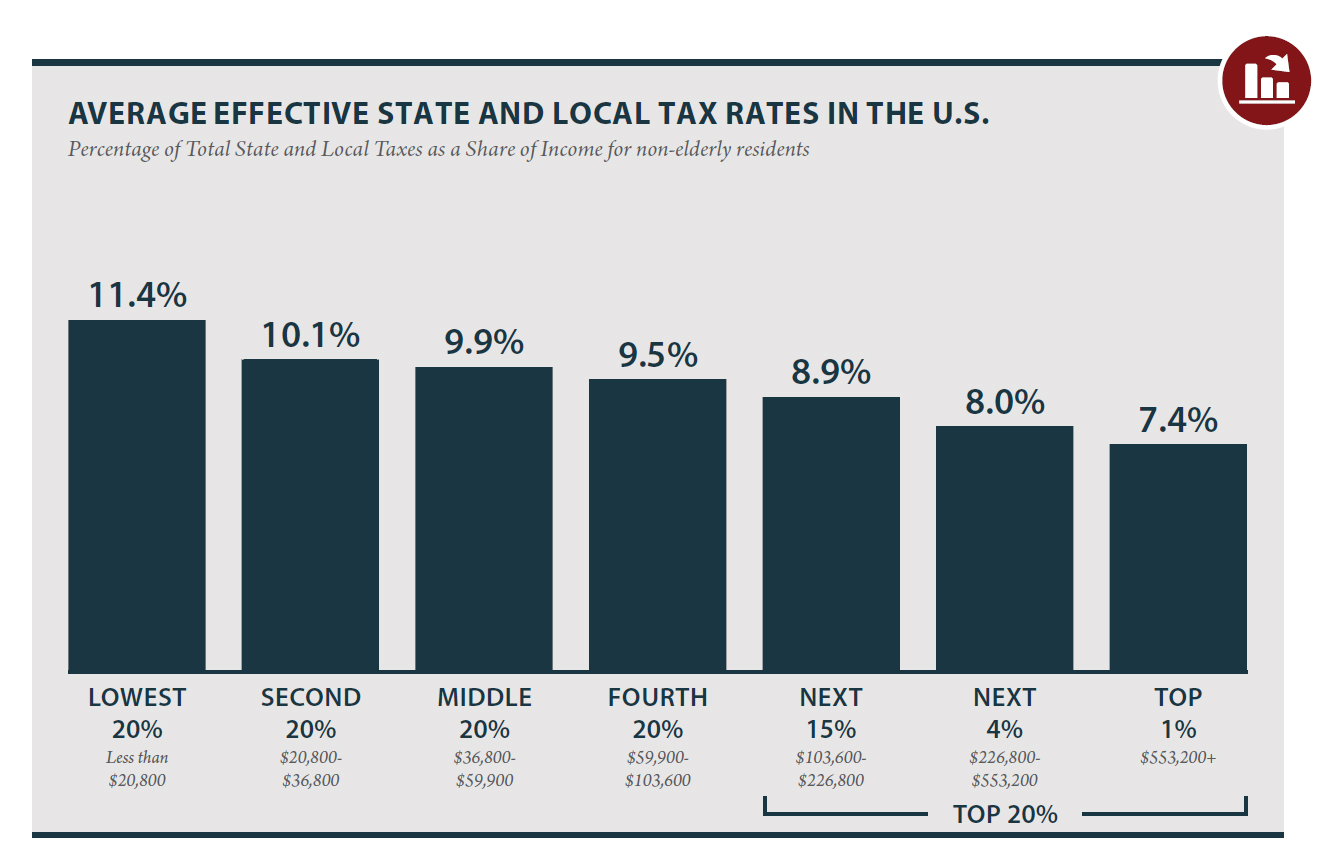

Ad Use our tax forgiveness calculator to estimate potential relief available. What is parent claimed tax forgiveness. For example in Pennsylvania a.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. We Can Help Suspend Collections Liens Levies Wage Garnishments. However they qualify for 100 percent Tax Forgiveness if they file a PA tax return.

State Tax Forgiveness. That same family of four with eligibility income more than 34000 but no greater. Provide free tax prep assistance to those who need it most.

See How We Can Help. Was this answer helpful. Form PA-40 SP requires.

States also offer tax forgiveness based on personal income standards. Ad Become a Tax-Aide volunteer. Ad Looking for tax forgiveness pa.

You can make a positive impact in your community and have fun doing it. For example a family of four couple with two dependent children can earn up to 34250 and qualify for Tax Forgiveness. The IRS Can be Very Reasonable if You Know How They Work.

We Can Help Suspend Collections Liens Levies Wage Garnishments.

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

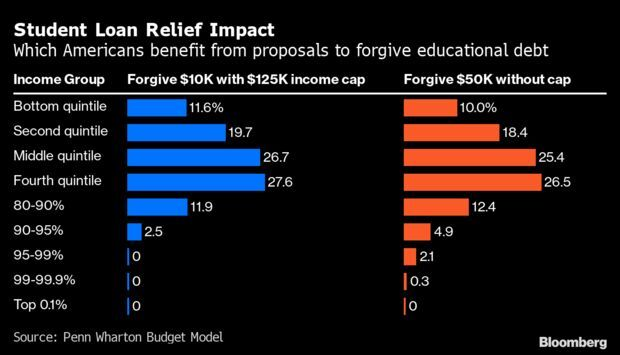

What To Know In Washington Biden To Unveil Student Loan Plan Bloomberg Government

Watch Bloomberg Markets The Close 3 18 2022 Bloomberg

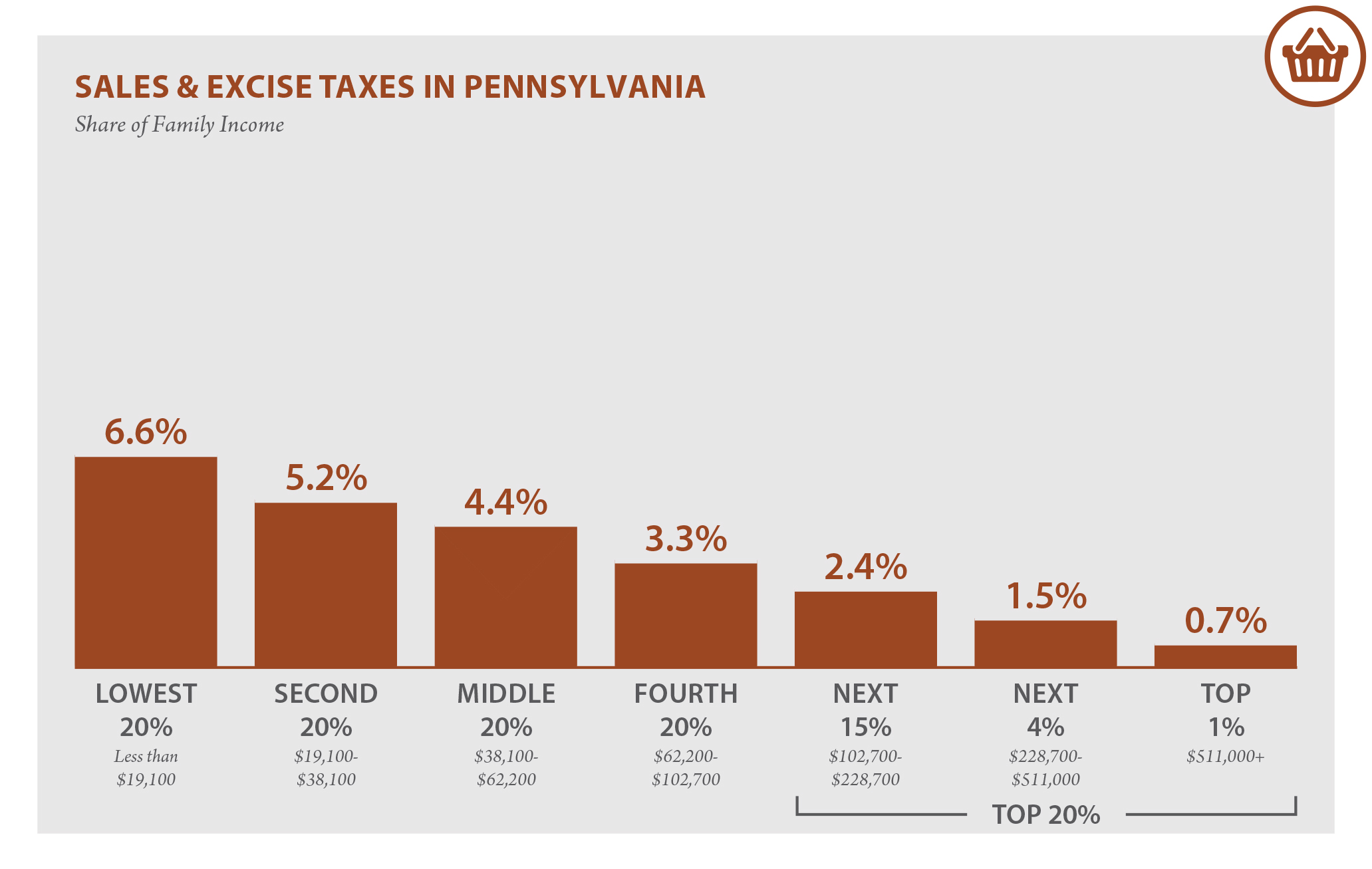

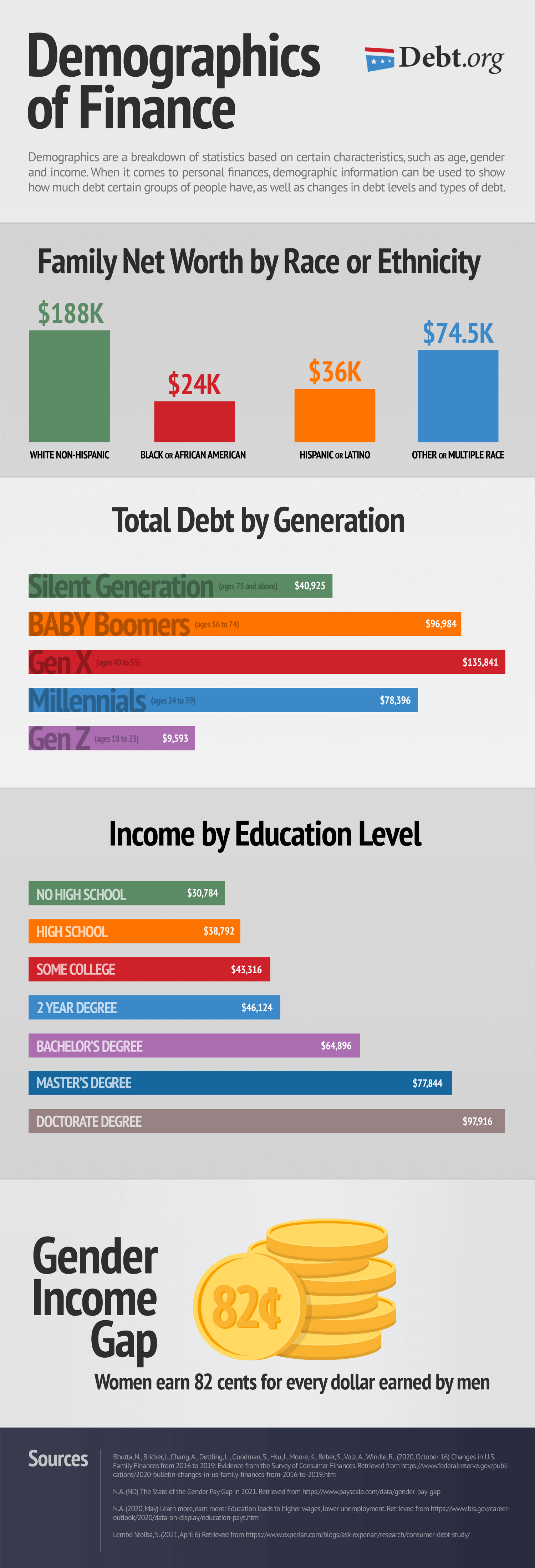

Pennsylvania Who Pays 6th Edition Itep

Pa Budget And Policy Center Pbpc Twitter

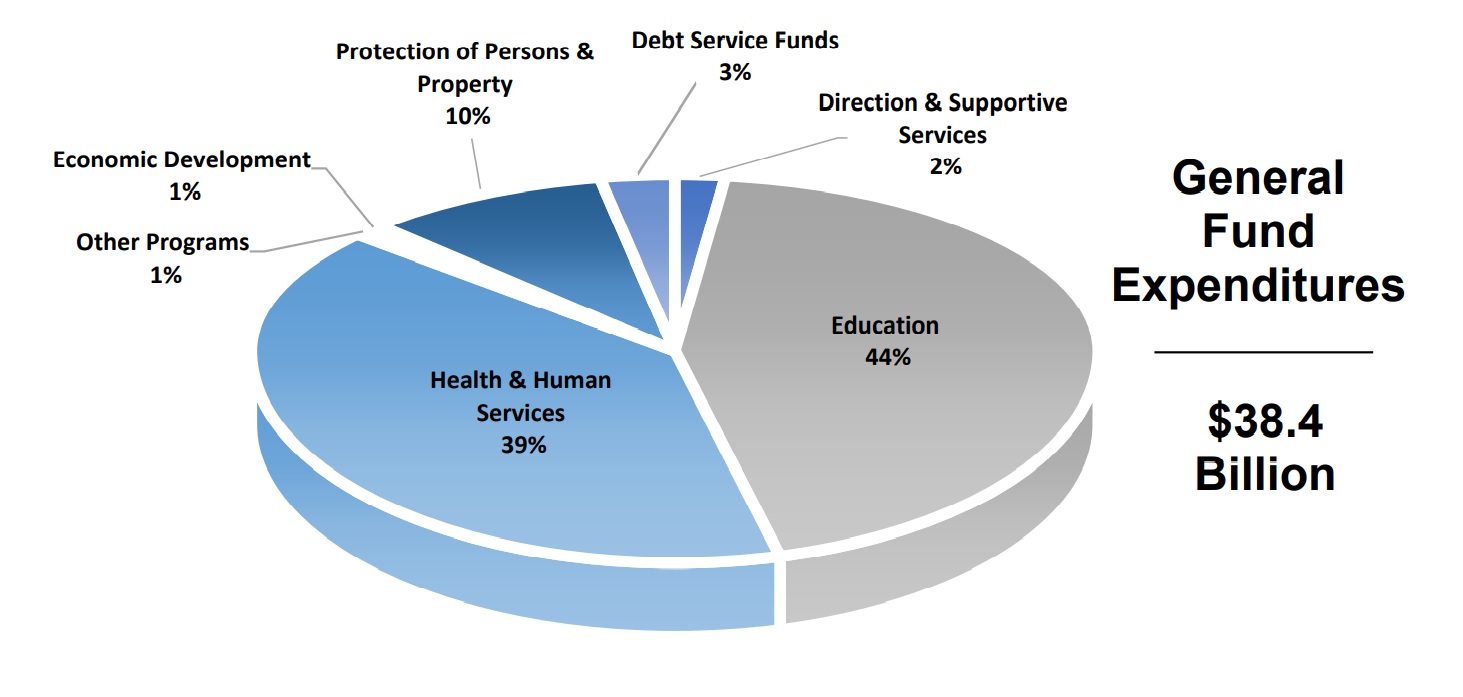

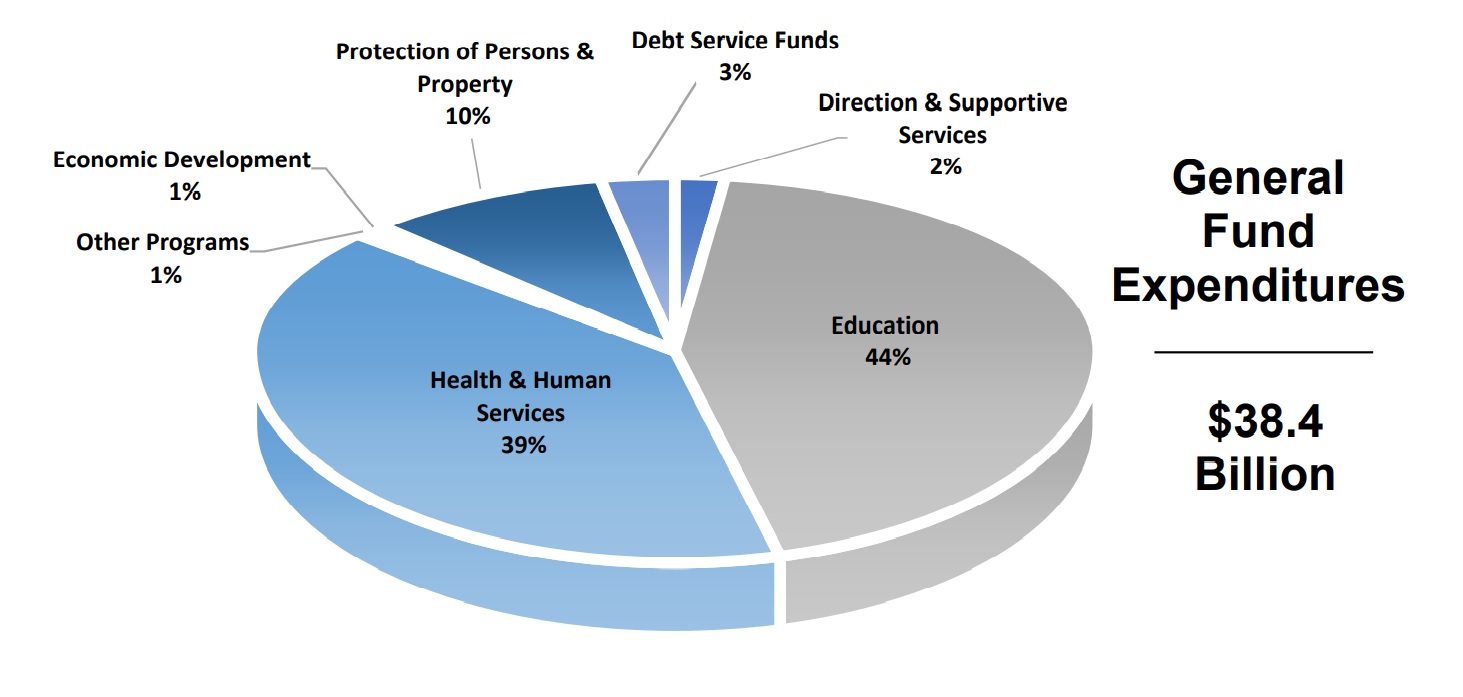

Gov Wolf S Proposed Budget Would Shift Education Spending Tax Burdens One United Lancaster

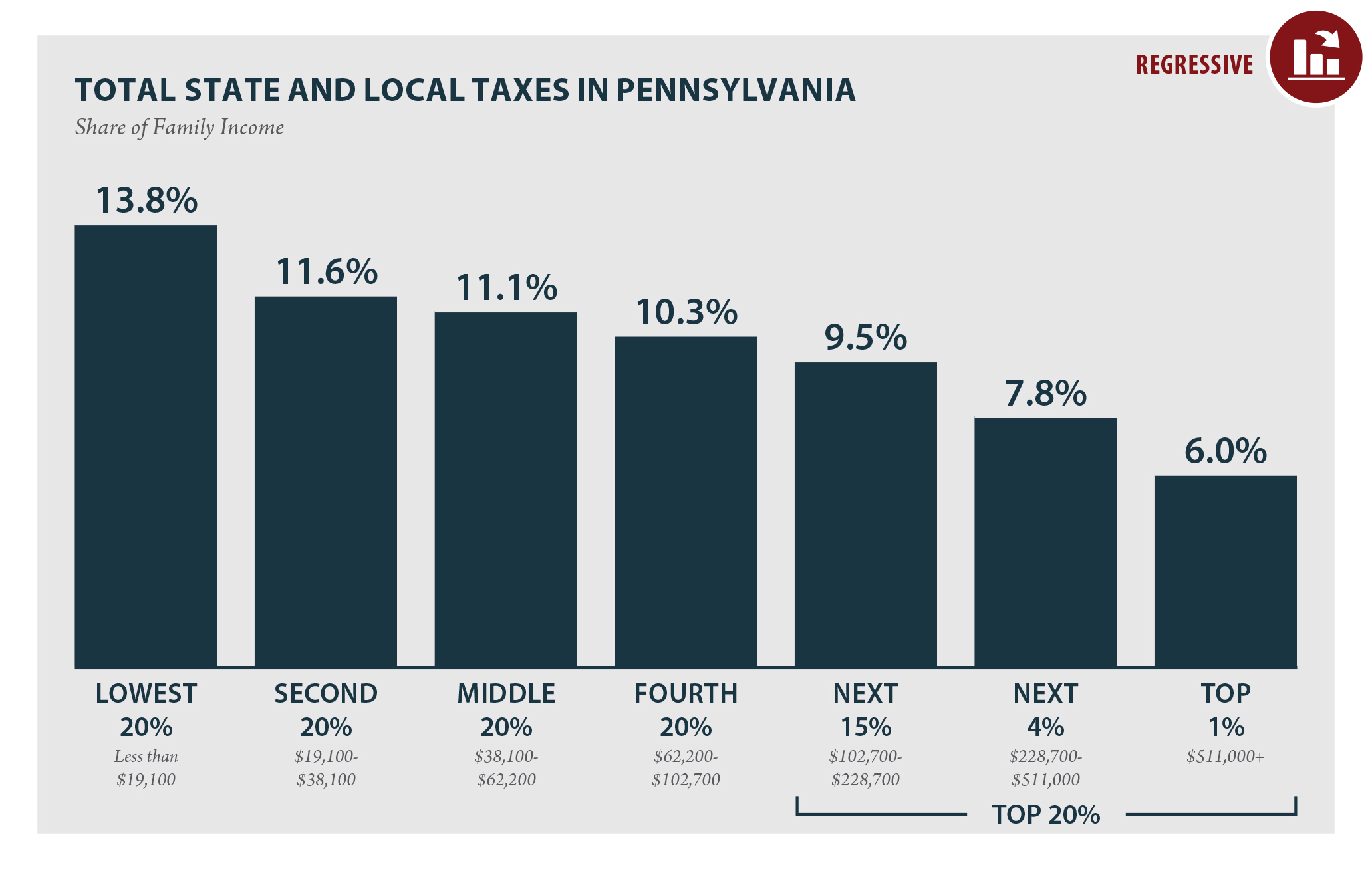

Consumer Debt Statistics Demographics In America

Salt Roadmap State And Local Tax Guide Resources Aicpa

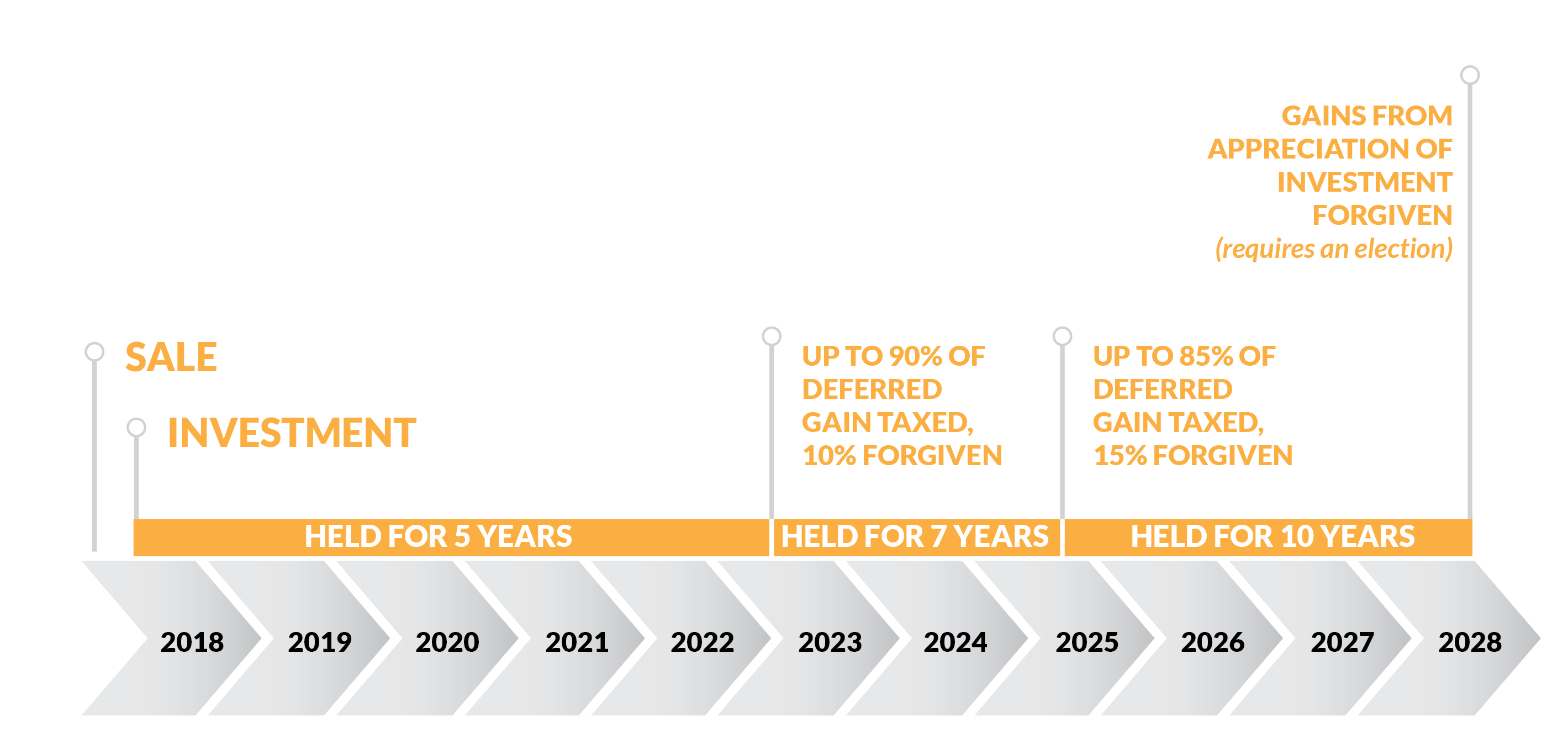

New Federal Opportunity Zone Program Tax Benefits Rkl Llp

Pennsylvania Student Loan Forgiveness Programs

Pennsylvania Who Pays 6th Edition Itep

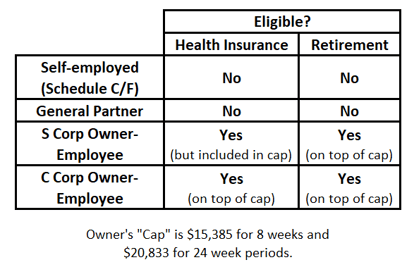

Key Takeaways From The Ppp Forgiveness Faq Document

New Federal Opportunity Zone Program Tax Benefits Rkl Llp

Four Winds News Only National Weather Service Employees Organization

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller